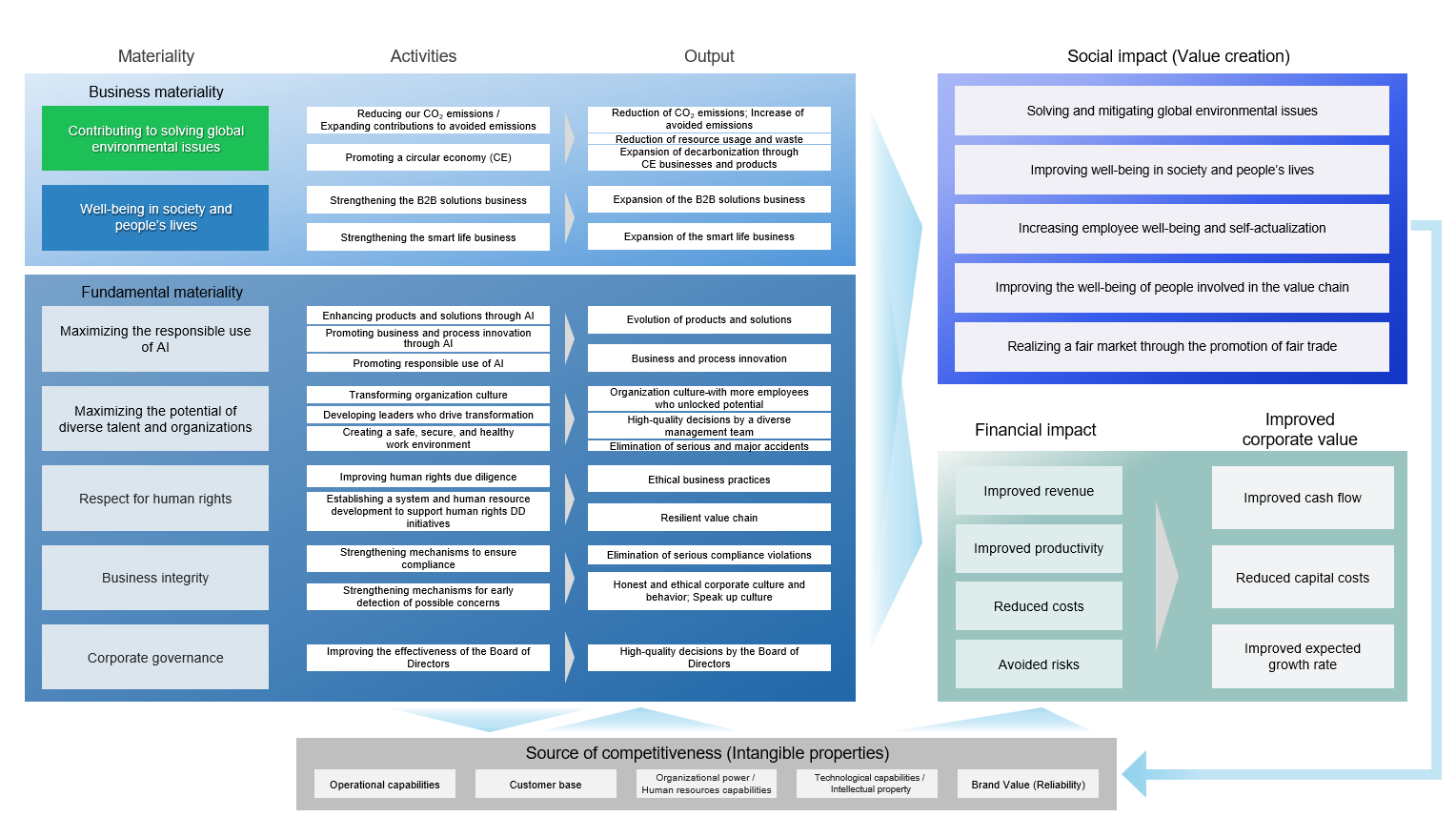

Value Creation Process and Materiality

Value Creation Process

The Value Creation Process details the kinds of value that we are generating in order to sustainably contribute to society and enhance our corporate value, and describes how this is being achieved. In essence, the process is as shown in the conceptual diagram below:

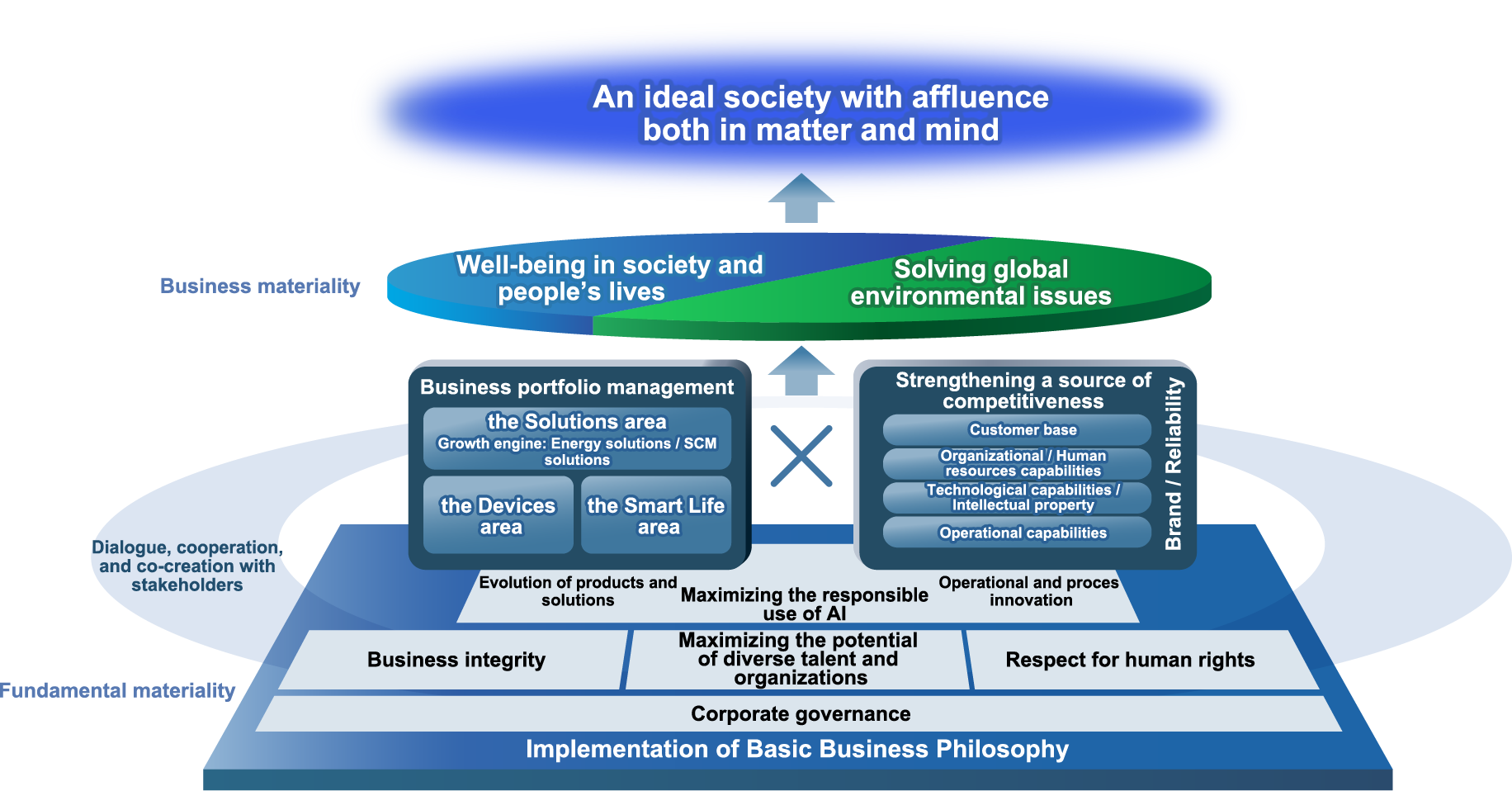

Toward its mission of achieving “an ideal society with affluence both in matter and mind,” the Panasonic Group will continue to create value through its business activities in the form of “contributing to solving global environmental issues” and “well-being in society and people’s lives” (= business materiality). To achieve this, we will optimize our business portfolio and strengthen our focus areas while also working to continually strengthen intangible properties, which are a source of competitiveness common to the Group. By combining these initiatives, we will maximize value creation.

At the same time, we will also focus on building and strengthening a management foundation that will enable sustainable value creation (= fundamental materiality). In addition to initiatives such as “corporate governance,” “business integrity,” “respect for human rights,” and “maximizing the potential of diverse talent and organizations,” we will enhance our business through the evolution of products and solutions and strengthen our source of competitiveness through operational and process innovation by “maximizing the responsible use of AI.”

The basis for all of these initiatives is our Basic Business Philosophy. As a public entity of society, we will engage in dialogue, cooperation, and co-creation with all relevant stakeholders, aiming to achieve the ideal society we envision together.

Materiality

▪Materiality (from FY2026)

At Panasonic we regard materiality as “priority issues for creating value for society”, and, to support this value creation, we have opted for business materiality, which involves the creation of value through business activities, and fundamental materiality, which involves the building and strengthening of a management foundation. These are important elements in the aforementioned value creation process.

We set and continually try to improve KPIs for each materiality, with a view to creating even greater value. Specific details are shown in the following table.

Materiality List

| Materiality | Activities (Examples) | Indicators | Targets | Report on related items | |

|---|---|---|---|---|---|---|

Business materiality | Contributing to solving global environmental issues | Contributing to decarbonization |

| CO2 reduction impact | 300 million tons (by 2050) | |

Emissions reduction in our own value chain | ||||||

Avoided emissions (FY2026) 47.50 million tons | ||||||

CO2 emissions from all factories | Net zero (by 2030) | |||||

Promoting a circular economy (CE) *2 |

| Amount of recycled materials used | Amount of recycled resins used 25,000 tons (FY2026) | |||

Number of circular economy business models | A total of 16 businesses (FY2026) | |||||

Well-being in society and people’s lives | Well-being in society |

| - | |||

Well-being in people’s lives | ||||||

Fundamental materiality | Maximizing the responsible use of AI | Evolving products and solutions through the use of AI |

| |||

Promoting operational and process innovation through the use of AI | ||||||

Maximizing the potential of diverse talent and organizations | Organization culture transformation |

| “UNLOCK” indicator *3 | FY2028: 60% | ||

Develop & appoint diverse, transformational leaders |

| Diversity ratio of the management team (Diversity of PHD Executive Officers (Total ratios of female, non-Japanese citizens and mid-career hires)) | More than half | |||

Ratio of female managers (PHD, PEX and the six operating companies) | 12% (April 1, 2028) | |||||

Safe, secure and healthy work environment |

| The number of serious or major accidents | Zero | |||

| Productivity indicator (EBITDA divided by personnel expenses) | Target (improvement rate) to be determined in line with the next medium-term strategy | ||||

Respect for human rights |

| Implementation rate of in-person training on forced labour prevention provided to Group sites in Japan and overseas that employ foreign migrant workers | 100% (FY2027) | |||

Level of understanding of participants in “Human Rights Due Diligence Promotion Training” to develop the promotion leaders at each operating company *4 | 80% | |||||

Business integrity |

| Occurrence of serious compliance violations | Zero | |||

Corporate governance |

| Enhancing constructive dialogue with shareholders | Implemented | Corporate information website | ||

Ratio of outside directors in the PHD Board of Directors | More than half | |||||

Chairperson of the Board of Directors to be Outside Director who are Independent Director | Implemented | |||||

Adoption of non-financial indicators in performance-based compensation for directors | Implemented | |||||

*1 The figures in parentheses indicate the amount of CO2 reduction compared to fiscal 2021 for the businesses subject to measurement in fiscal 2025.

*2 The factory waste recycling rate, based on the definition we have used, has maintained a high level of more than 99% since the past. As we are reviewing the definition of this indicator to ensure its alignment with global trend of rules, this indicator is not listed in the table above.

*3 Favorable response rate for both questions in the Employee Opinion Survey, “Motivation from the company or supervisors” and “No significant barriers at work” (Target: Group employees globally)

*4 The post-training questionnaire focuses on assessing the level of empathy towards “business and human rights” and the level of awareness regarding its promotion, in addition to the level of understanding of the content.

▪Materiality identification process

In FY2024, the Group identified important opportunities and risks as materialities from the two perspectives of financial effects on the Group and impact on society. The identification process is as follows:

- List issues that could represent opportunities and risks based on demands from society and foreseeable future challenges

- Assess the importance of these issues from the perspective of the Group and its stakeholders and extract materialities

- Confirm the validity of this process and the extracted materialities through dialogue with multiple external experts

- Identify materialities after deliberation at the meetings of the Group’s Sustainability Management Committee and the Group Management Meeting and with the Board of Directors.

Furthermore, starting from FY2026, we have narrowed down our materialities to “priority issues for creating value for society” and are reviewing them to ensure they are consistent with our future business direction and strategies.

▪Attempt at visualizing social impact – CE businesses

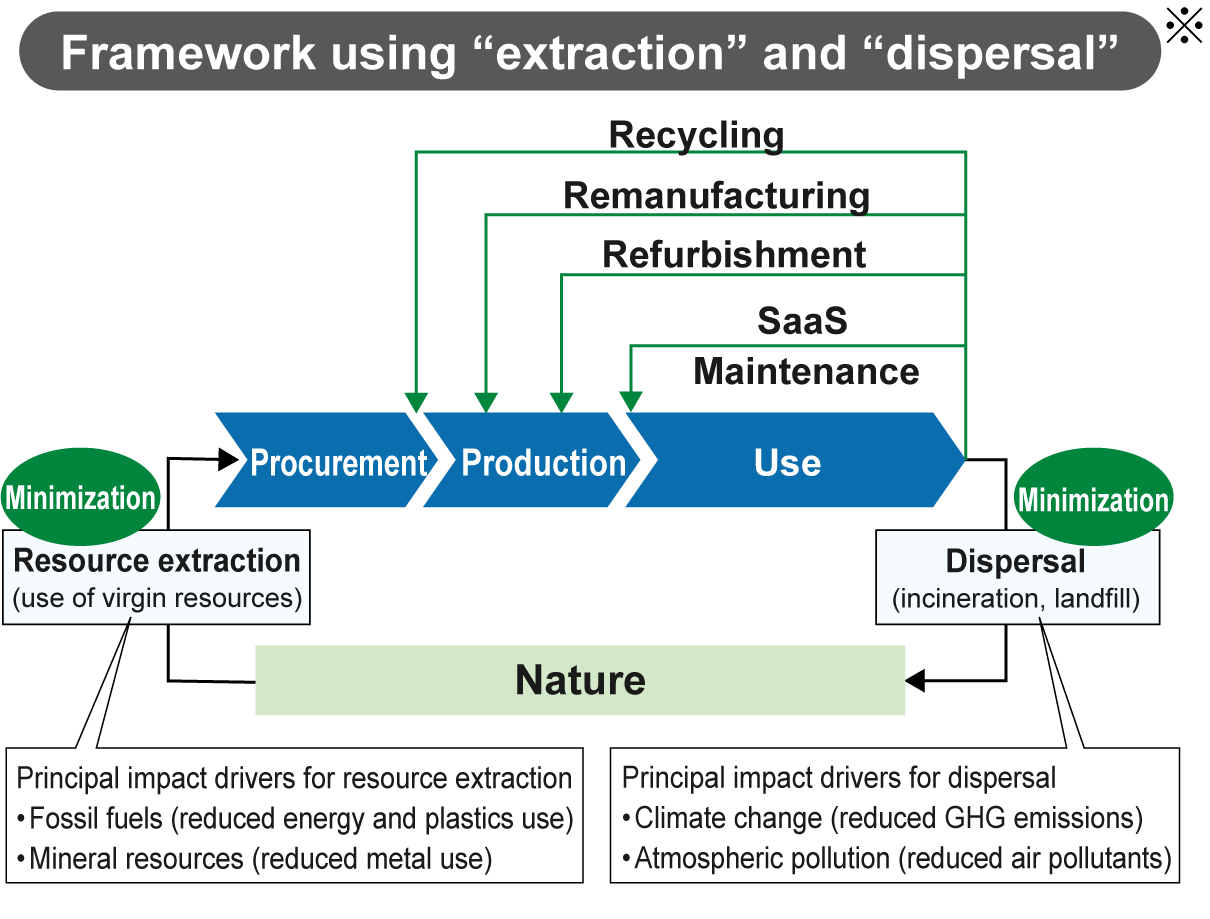

The Panasonic Group is aiming to strengthen dialogue with stakeholders by translating the social impact of its businesses into monetary value, and to thereby gain an objective view of the significance and outcomes of our initiatives. In a new effort this year, we are attempting to value the environmental impact of our circular-economy (CE) businesses (in which the causal relationships are highly complex) in monetary terms. This section outlines our approach and the progress that we have achieved in this pioneering impact-accounting exercise.

The environmental contribution made by our CE businesses extends beyond simple physical indicators like product recycling ratios and CO2 reductions and can be perceived as the “environmental value” provided to society. We believe it is important to carry out an integrated and objective assessment of this value and communicate the result to our stakeholders in an easy-to-understand way. With this in mind, the Panasonic Group has started using the common yardstick of currency to visualize the social benefits created when environmental burdens are eased and resources are recycled. In concrete terms, CE businesses help ease these burdens by minimizing both the extraction of natural resources for economic activity and the dispersal of waste, such that nature can still cope. These activities form the core of our definition of “environmental value” and impact accounting plays a key role in fulfilling our corporate social responsibility.

The environmental impact of our CE businesses is defined as the difference they can deliver compared to conventional linear models. This difference includes both positive impacts, such as reduced waste, and negative impacts, such as the energy consumed for recycling. Impact accounting is applied using a monetization factor for each impact driver based on indicators and methodologies such as the International Foundation for Valuing Impacts (IFVI) and Life Cycle Impact Assessment (LCIA).

* This framework was created with reference to the following:

WBCSD, Circular Transition Indicators v4.0: Metrics for business, by business, 2023

Yuki Isogai, Hitsuzen-to-shiteno circular business, Nikkei BP, 2024

Principal environmental impacts

Impact driver | Description of the impact | Principal impact(s) |

|---|---|---|

Mineral resources | Impact on the loss of future supply due to the present removal of the resource (impact on the extinction of the resource stocks/expense and profits from future exploitation) | Reduced mineral use due to material recycling |

Land use | Impact on the ecosystem services lost when land is converted and occupied for mineral mining | Area of land altered by mineral mining /area of land prevented from alteration |

Fossil fuels | Impact on the loss of future supply due to the present removal of the resource (impact on the extinction of the resource stocks/expense and profits from future exploitation) | Energy used for the company and VC business activities |

Fossil fuels | Reduced plastic use for the company and VC business activities | |

Water consumption | Impact on human health (water-related infections and malnutrition) due to water consumption, impact on human lifestyle (loss of cultural assets, communities, etc.) due to droughts caused by water shortages, impact on access to water. | Water consumed for business activities |

Climate change | Impact on socio-economic aspects by the effects of CO2 emission on human health (increased mortality), biodiversity (reduced area for plant cultivation, increased extinction risk), labor productivity, income from energy consumption and production, etc. | CO2 emitted by the company and VC businessd activities |

Air pollution | Impact of other atmospheric emissions (SOx, NOx, PM2.5) on human health (mortality and disease rates, chronic bronchitis, restricted activity), visibility (especially for shipping, aviation, recreation, etc.), and on agriculture | Pollutants emitted to the atmosphere by the company and VC business activities |

Waste | Impact on socio-economic aspects by the effects of CO2 emission on human health (increased mortality rates), biodiversity (reduced area for plant cultivation, increased extinction risk), labor productivity, income from energy consumption and production, etc. | Reduced CO2 emitted during product disposal |

In 2024, we quantified in monetary value the environmental impact of some CE businesses in the Panasonic Group. Here we highlight the results for our consumer electronics recycling and refurbishing businesses.

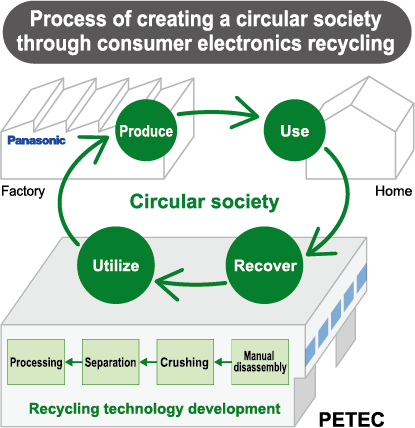

Consumer electronics recycling business (Panasonic Eco Technology Center: PETEC)

PETEC collects the four appliance types covered by the 2001 Home Appliance Recycling Law—TVs, air conditioners, refrigerators/freezers, and washing machines—from designated pick-up points, dismantles them, and recycles the materials. Useful materials such as iron, copper, and aluminum are recovered from the used appliances, helping to promote the efficient use of resources. Although material recycling plays a particularly significant role in alleviating climate change and promoting the sustainable use of resources, it also has some downsides, such as the generation of CO2 emissions during transportation. All the corresponding impacts are evaluated to calculate the environmental value in numerical terms.

Consumer electronics refurbishing business (Panasonic Factory Refresh)

Panasonic Factory Refresh refurbishes consumer electronics slated for disposal and returns them to the market as refurbished products. Focusing on TVs and dishwashers in 2024, the company analyzed the effect on the environment of restoring initially faulty appliances and extending the service life of subscription products. Although the positive impacts (such as reduced waste, and the avoidance of high CO2 emissions from manufacturing and disposal) were partially offset by the additional energy usage, water consumption, and CO2 emissions resulting from the restoration process, the numerical data showed an overall positive effect.

The positive environmental impact delivered by the two businesses in 2024 was assessed as 1.71 billion yen and is expected to reach 1.75 billion yen in 2025. This type of quantitative assessment highlights the areas on which each CE business should focus. It could also be used in future as an analysis tool to assist business decision-making.

Environmental impact delivered by the consumer electronics recycling and refurbishing businesses

Unit: million yen

| Mineral resources | Land use | Fossil fuels | Fossil fuels | Water consumption | Climate change | Air pollution | Waste | Total |

|---|---|---|---|---|---|---|---|---|---|

2024 | 472 | 17 | 358 | 32 | -3 | 799 | 24 | 11 | 1,709 |

2025 | 479 | 17 | 370 | 44 | -4 | 811 | 24 | 11 | 1,753 |

| 2024 | 2025 |

|---|---|---|

Mineral resources | 472 | 479 |

Land use | 17 | 17 |

Fossil fuels | 358 | 370 |

Fossil fuels | 32 | 44 |

Water consumption | -3 | -4 |

Climate change | 799 | 811 |

Air pollution | 24 | 24 |

Waste | 11 | 11 |

Total | 1,709 | 1,753 |

▪FY2025 materiality results

| Materiality | Indicators | Targets | Results | Report on related items |

|---|---|---|---|---|---|

Group common strategy | Global warming and resource depletion | CO2 reduction impact | 300 million tons (by 2050) | Emissions reduction in our own value chain | Sustainability Data Book 2025 |

Avoided CO2 emissions | |||||

CO2 emissions from all factories | Net zero (by 2030) | A total of 45 factories | |||

Factory waste recycling rate | 99% or more | 99.2% | Sustainability Data Book 2025 | ||

Each customer’s life-long health, safety and comfort | Not set | - |

| ||

Foundation for sustainable value creation | Business integrity | Occurrence of serious compliance violations | Zero | Zero*2 | Sustainability Data Book 2025 |

Supply chain management | Not set | - |

| ||

Employee well-being | Occurrence of serious or grave accidents | Zero | 7 serious accidents | Sustainability Data Book 2025 | |

(1) Employee engagement / (2) Employee enablement in the Employee Opinion Survey | The highest global standard (80% FY2031) | (1) 68% | |||

Corporate governance | Enhancement of constructive dialogue with shareholders | Implemented | Implemented | Corporate information website | |

Evaluation of the effectiveness of the Board of Directors and implementation of improvement measures | Implemented | Implemented | |||

Ratio of outside directors in the PHD Board of Directors | 1/3 or more | 46.1% | |||

Adoption of non-financial indicators in performance-based compensation for directors | Implemented | Implemented | |||

Respect for human rights | Promotion of correction of issues identified in human rights due diligence for each Group company which may cause forced labor | Implemented | Implemented | Sustainability Data Book 2025 | |

Implementation rate of in-person training on forced labour prevention provided to Group sites in Japan and overseas that employ foreign migrant workers | 100% | 40.6% | |||

Cyber security | Provision of education and training for all employees to improve security awareness and promote behavioral change | More than four times a year | 5 times | Sustainability Data Book 2025 | |

Collection and monitoring of threat and vulnerability information by an expert team, and implementation of necessary measures | Implemented | Implemented | |||

Incident response training by an expert team in anticipation of cyber attacks | More than once a year | 2 times | |||

Number of serious incidents | Zero | Zero | |||

*1 The figures in parentheses indicate the amount of CO2 reduction compared to fiscal 2021 for the businesses subject to measurement in fiscal 2025.

*2 It has been discovered that Panasonic Industries Co., Ltd. (“PID”), a subsidiary of the Company, engaged in multiple irregularities during the previous fiscal year in the process of the certification by UL Solutions (“UL”), a third-party safety science organization in the U.S., for electronic materials manufactured and sold by PID. In response to this, PID established an external investigation committee composed of external experts and conducted investigations into the irregularities in the process of the certification by UL and other quality irregularities. During this fiscal year, PID published the investigation report it received from the external investigation committee and the measures it formulated to prevent recurrence.

*3 Of the materialities before the review, “supply chain management” will be addressed under the items “contributing to solving global environmental issues” and “respect for human rights.” Meanwhile, “cyber security” is a major element of our company’s risk management and will be addressed as an important risk item in our ERM activities. Accordingly, these items have been excluded from the current materiality (from FY2026).