To verify the strategic resilience of our business, Panasonic Group initially analyzed their impacts of climate change risks and conducted a scenario analysis based on the result of the impact analysis.

In the course of the impact analysis, we listed every possible impact on our business from climate change or measures against climate change, and then identified the risks and opportunities brought by such impacts by Panasonic Group's major businesses. The following table lists risks and opportunities by business, and integrated results of the different impacts of climate change (Table 1).

Table1 Extracted Risks and Opportunities

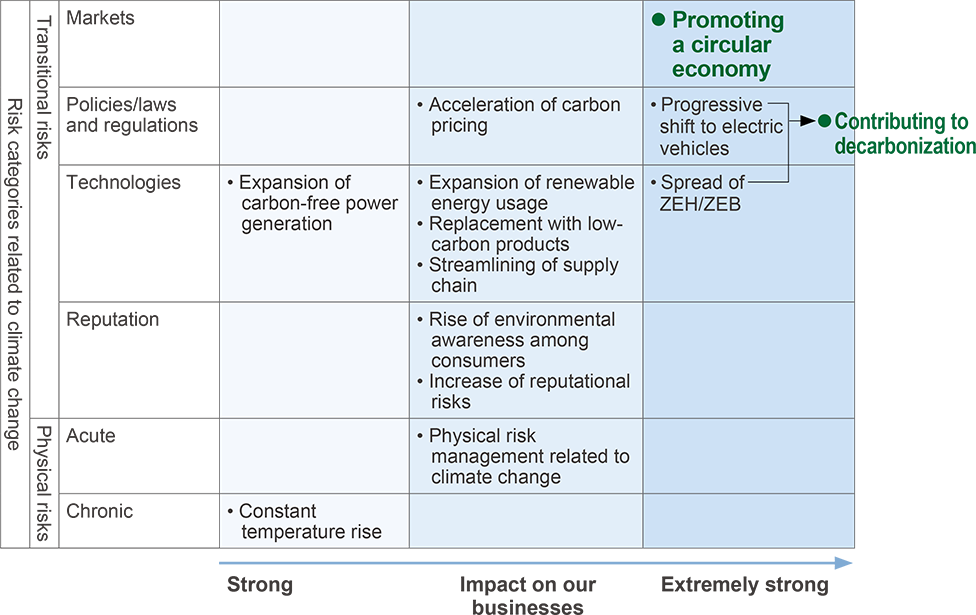

The following figure shows the impact analysis results of climate change risks (Figure 1) regarding the results of analyzed factors based on the identified risks and opportunities and analyzed impact on our businesses.

Figure 1 Impact Analysis of Climate Change Risks

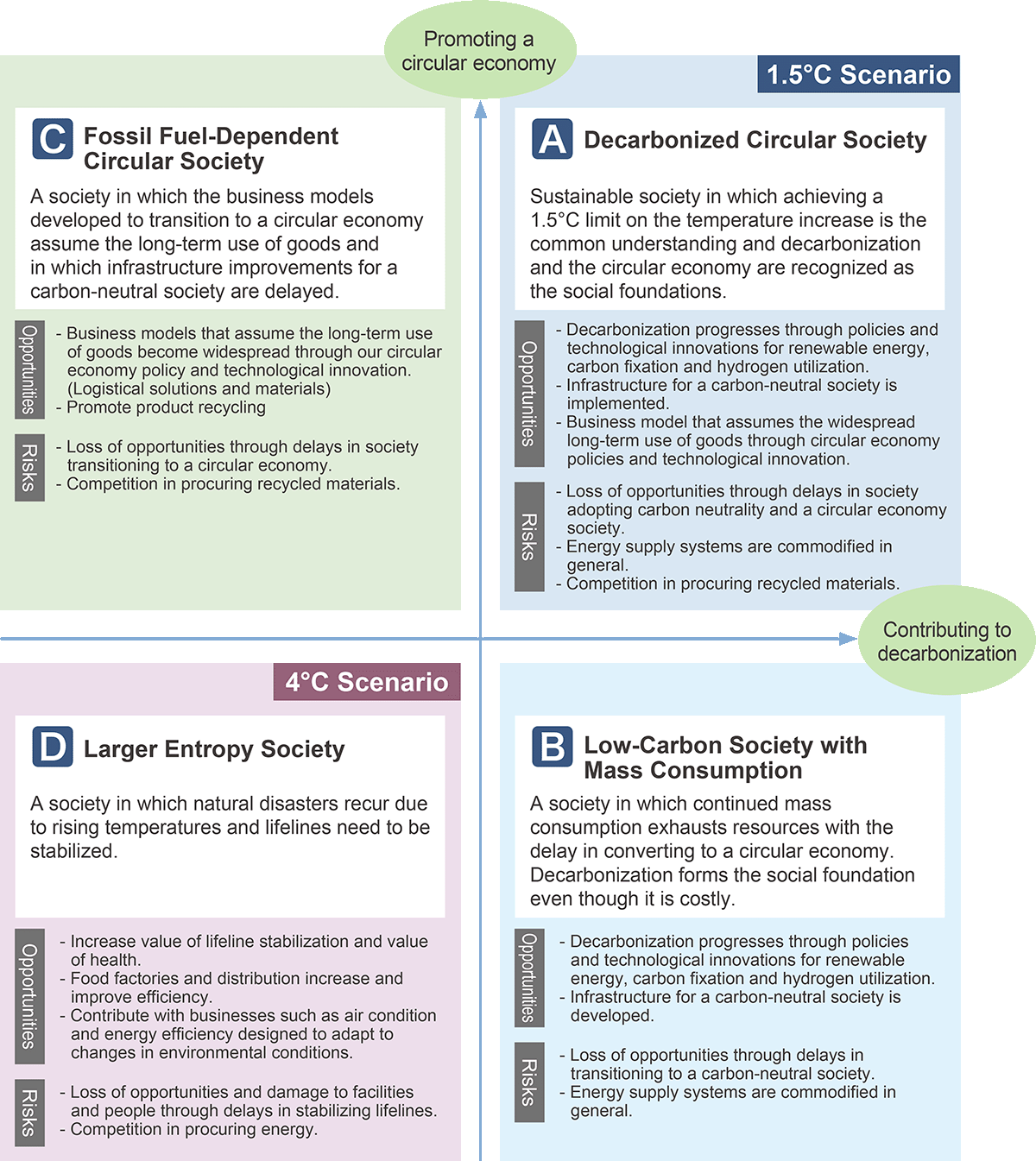

From a climate change viewpoint, we identified “Promoting a circular economy” and “Contributing to decarbonization” and their materiality as factors that have a very significant impact on our business. With these two factors as the axes of a matrix, we created four scenarios for 2050 in the following quadrants (Figure 2). We defined the 1.5°C scenario as a society which contributes to decarbonization and promotes a circular economy, and the 4°C scenario as a society in which the contributing to decarbonization is stalled and implementation of a circular economy is delayed.

Figure 2 Four Scenarios

The Decarbonized Circular Society (A)is equivalent to the 1.5°C scenario. If (A) doesn’t develop a circular economy, it becomes (B) a Low-Carbon Society with Mass Consumption. If (A) doesn’t develop decarbonization, it becomes (C) a Fossil Fuel-Dependent Circular Society. Scenario (D) a Larger Entropy Society, is equivalent to the 4°C scenario.

Fuller descriptions of each set of social conditions are given below.

●Impact on industries

Concurrent progress of legislation and technological innovation related to contributing to decarbonization and creating a circular economy help to form a related infrastructure for a carbon-neutral society and Circular Economy. This encourages investment in decarbonization in automotive and real estate industries, and advances the shift to business models that assume long-term use of goods in industries involved in the supply chain. It is also expected that not only products but also the construction of sustainable towns designed for carbon neutrality and Circular Economy will attract investment.

●Changes in customer value

Consumers: Eco-consciousness, cost reduction, ethical, on-demand usage, etc.

Corporations: Eco-consciousness, cost reduction (energy saving, asset-light approach, better fuel efficiency, etc.), effect and efficiency enhancement (maximization of customer value, i.e. better experience value, etc.), sufficient information disclosure

●Impact on industries

Progress of carbon-related legislation (NEV/ZEV laws and ZEH/ZEB subsidy policies, etc.) and technological innovation (reduced cost of renewable energy and storage batteries, etc.) encourages standardization for decarbonization in the automotive and real estate industries and attracts investment. This helps the shift to electrification and a renewable energy infrastructure.

Adoption of renewable energy and hydrogen also expands.

●Changes in customer value

Consumers: Eco-consciousness, cost reduction (energy saving, better fuel efficiency, etc.).

Corporations: Eco-consciousness, energy saving and better fuel efficiency (downsizing, weight reduction, high density and capacity, high efficiency, etc.).

●Impact on industries

Progress in technological innovation of waste plastic and for a circular economy (data linkage, material recycling, etc.) and their related legislation eliminate waste in the supply chain and encourage a shift to a circular economy. Corporations involved in the supply chain (manufacturers, distributors, etc.) change their business models from sales and consumption based models to those that assume long-term usage of goods, including leasing, sharing, and repair. Products made of recycled resources become mainstream backed up by the formation of waste collection networks and material recycling systems.

●Changes in customer value

Consumers: Eco-consciousness, ethical, on-demand usage, etc. Corporations: Effect and efficiency enhancement (maximization of customer value, i.e. better experience value, etc.), cost reduction (energy saving, asset-light approach, etc.).

●Impact on industries

Changes in rainfall amounts and patterns make it difficult to control the yield and quality of agricultural products. This encourages a shift to demand and supply matching consumption, which eliminates waste in distribution. Deterioration of living and working environment and increases in illness due to constant temperature rises expand demand for companies related to indoor environments and health (building, home appliances, healthcare, etc.). In response to the increase in natural disasters, investment in infrastructure resilience to maintain the supply chain will increase.

●Changes in customer value

Consumers: Lifeline stabilization and resilience enhancement, health.

Corporations: Productivity enhancement, demand and supply matching, supply chain resilience.

We can address the risks and opportunities corresponding to the above scenarios through any of our six main operating companies shown below.

- Panasonic Corporation

(Home appliance business, Air quality and air conditioning business, Food distribution business,

Smart Energy System business, Electrical facility materials business) - Panasonic Connect Co., Ltd.

- Panasonic Energy Co., Ltd.

- Panasonic Industry Co., Ltd.

- Panasonic Entertainment & Communication Co., Ltd.

- Panasonic Housing Solutions Co., Ltd.

For each type of society, we have formulated strategies for our six operating companies from the viewpoint of climate change. Some of the strategies are listed below, with the applicable society type indicated by the corresponding scenario from (A) to (D).

The total sales of the operating companies for fiscal 2025 are shown as financial information.

1. Panasonic Corporation

Sales for fiscal 2025: 3,584.2 billion yen

1-1 Living Appliances and Solutions Company

|  |  |  | |

|  |  |

1-2 Heating & Ventilation A/C Company

|  |  |  |  |

|  |  |  |  |

1-3 Cold Chain Solutions Company

|  |  |  | |

|  |  |

1-4 Electric Works Company

|  |  |  |  |

1-5 Direct Control (Hydrogen Related Businesses)

|  |  |  |

2. Panasonic Connect Co., Ltd.

Sales for fiscal 2025: 1,333.2 billion yen

|  |  | ||

|  |  |

3. Panasonic Industry Co., Ltd.

Sales for fiscal 2025: 1,083,6 billion yen

|  |  | ||

|  |  | ||

|  |  |  | |

|  |  |

4. Panasonic Energy Co., Ltd.

Sales for fiscal 2025: 873.2 billion yen

|  |  |  | |

|  |  |  |

5. Panasonic Entertainment & Communication Co., Ltd.

Sales for fiscal 2025: 278.0 billion yen

|  |  | ||

|  |  |

6. Panasonic Housing Solutions Co., Ltd.

Sales for fiscal 2025: 479.5 billion yen

|  |  | ||

|  |  | ||

|  |  |

The scenario analysis found that either of the businesses in our group can respond to the situation even if any of the 4 scenarios of the societies is achieved. In other words, the analysis successfully verified the resilience of our business strategies. The analysis also helped us understand that we can contribute to building a sustainable society through our businesses. We continue our efforts to build the 1.5˚C world, represented by our society (A).